Table of Contents

Toggle- What is a Mega Backdoor Roth 401k?

- How the Microsoft Mega Backdoor Roth Works

- How to Make After-Tax Contributions to Your Microsoft 401(k)

- How The Microsoft Mega Backdoor Roth Can Help Reduce Taxes

- Pros and Cons of the Microsoft Mega Backdoor Roth Conversion

- Is the Mega Backdoor Roth a Good Idea?

- FAQ’s

- Conclusion and Action Items

What is a Mega Backdoor Roth 401k?

The Microsoft Mega Backdoor Roth 401(k) is a feature within the 401(k) plan that allows you to:

- Save additional money each year on an after-tax basis into your 401(k) and

- Convert those dollars into a tax-free Roth subaccount.

It’s a relatively new benefit offered at many tech companies. And it can be one of the biggest benefits available to you as a Microsoft employee. Like a Roth IRA, the Roth 401(k) is tax-free money. Once in the account, your money grows tax-free, and unlike a traditional 401(k), the funds can be withdrawn without taxes in retirement.

Again, the Microsoft Mega Backdoor Roth401(k) comes with two big benefits.

- You gain the ability to save additional money each year into a tax-advantage account($30,250 for Microsoft employees) and

- By converting the money to a Roth, your growth and income in the account will compound tax-free and qualified withdrawals at retirement are also tax-free.

How the Microsoft Mega Backdoor Roth Works

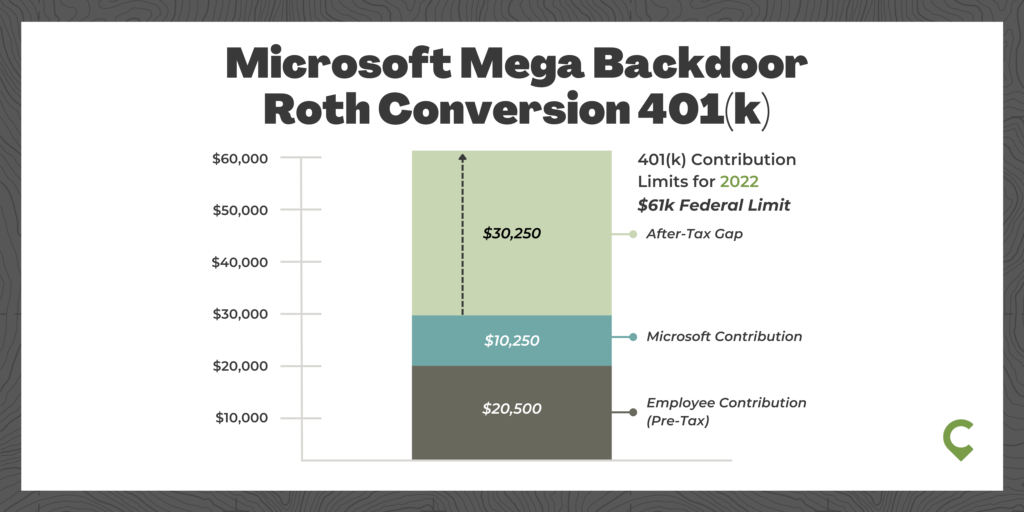

The Mega Backdoor Roth allows you to save money on an after-tax basis into your 401(k). The federal limit on pre-tax individual contributions into a 401(k) for 2022 is $20,500 plus an extra $6,500 catch-up contribution for those over 50. These pre-tax contributions reduce your taxable income and, therefore, your tax bill today.

But, the federal limit, pre- and post-tax,on total 401(k) contributions is $61,000 in 2022. Again, for those over 50, this is higher by the additional $6,500 catch-up contribution. The last piece of this puzzle is Microsoft’s contributions which also count against the $61,000 annual cap. At Microsoft, 401(k) contributions are matched at 50% of the employee’s contributions up to a limit of $10,250. In other words, to get the full and generous Microsoft match, you must contribute $20,500 in 2022.

So, at Microsoft, even for those maxing out their employee ($20,500) and employer contributions ($10,250), there remains a gap of $30,250 before hitting the federal limit on 401(k) contributions, which can be filled with after-tax contributions. It’s important to note that you must max out your contributions to participate in the Mega Backdoor Roth 401(k). Otherwise, donations would be pre-tax and fill the pre-tax bucket ($20,500) first.

The Microsoft 401(k) and Mega Backdoor Roth are administered through Fidelity, and elections are made via the Net Benefits website.

Let’s look at how this is done.

How to Make After-Tax Contributions to Your Microsoft 401(k)

To set your Microsoft Mega Backdoor Roth contributions, you must log in to your 401(k) account via Fidelity Net Benefits.

From there, making an after-tax contribution to your Microsoft 401(k) requires three steps.

The first step is to set your pre-tax contribution amounts.

You can elect to contribute 0-90% of your salary to a traditional 401(K) “PRE-TAX” or the ROTH option. Again, for those under 50, you can contribute up to $20,500 plus an additional $6,500 for those 50 and older.

Remember, for those looking to participate in the Mega Backdoor Roth, you must first max out your pre-tax contributions, so make sure the percentage of your salary allocated in step one totals at least $20,500.

Next, set your after-tax contribution amount.

Again, you can set your election between 0-90% (in increments of 1%). Those looking to front load contributions with percentage may be higher, or you may elect to smooth your contributions throughout the year. Either way, contributions must be entered on a percentage basis, so you’ll need to calculate what percentage of your salary will get you to your targeted savings goal for the after-tax portion of your account.

Lastly, convert your after-tax contributions to a Roth.

This last step is crucial; failing to set it could result in additional taxes down the road. At Microsoft, under the “ROTH IN PLAN CONVERSION” section, you will select the option to “Convert After-tax to Roth.” Selecting this option will mean that all future after-tax contributions will automatically be converted to Roth.

Any after-tax contributions made previously do not get converted. In this case, you will need to call Fidelity and request that the current after-tax dollars are converted to Roth. (Please note that converting existing after-tax dollars to Roth could result in taxes being due, so please consult with your tax professional before making this request to understand the magnitude.)

How The Microsoft Mega Backdoor Roth Can Help Reduce Taxes

The Mega Backdoor Roth strategy reduces taxes in two key ways.

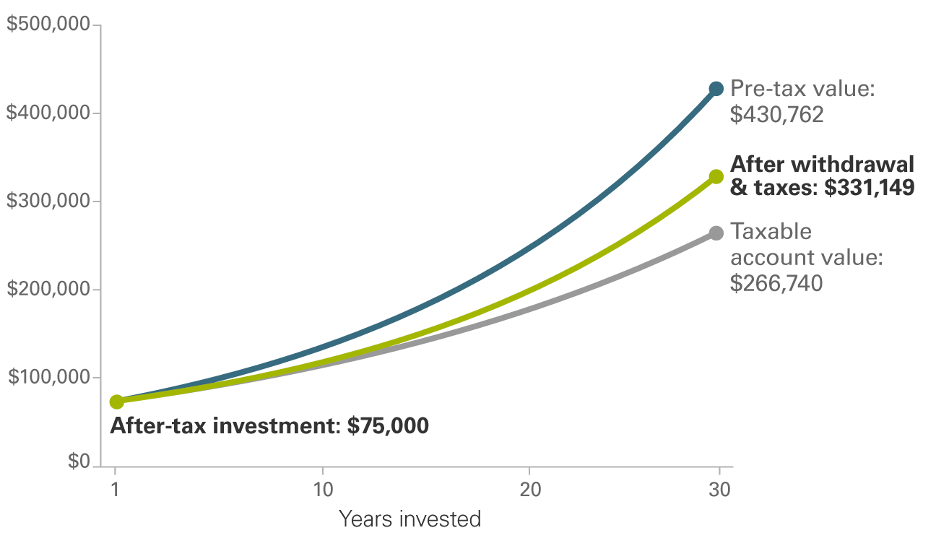

First, your income and capital gains compound over time without taxes dragging down returns. This is the tax-deferral benefit.

Next, the funds are tax-free when you withdraw them at retirement.

Compared to saving the money into a fully taxable account, this benefit can add up.

Source: investors.vanguard.com

Tax Considerations

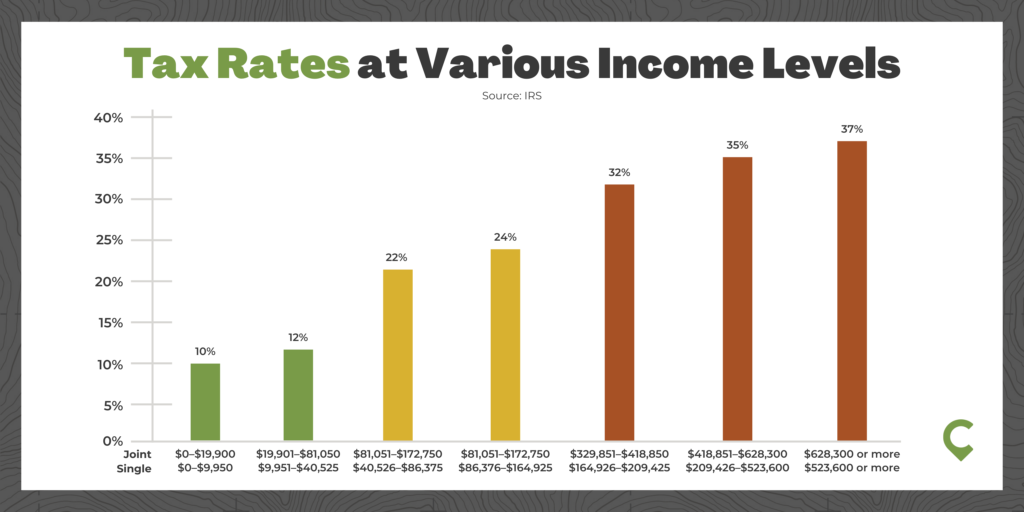

When weighing the tax consequences of 401(k) contributions and the Microsoft Mega Backdoor Roth, the key concept to remember is current vs. future tax rates.

While predicting future tax rates is impossible, you can assess where you currently fall in the tax structure. Right now, Federal tax brackets range from a low of 10% to the top marginal tax bracket of 37%. Those falling in the lower half of the range should consider paying taxes now vs. deferring income by taking the tax break now for those at the top end of the tax brackets.

Most people who are working, earning a good income, and considering contributing to an after-tax Mega Backdoor Roth fall on the higher end of the marginal tax brackets and therefore taking the tax benefit today makes the most sense.

Let’s look at these considerations through three of the most common scenarios we get asked about.

Why not just contribute Pre-Tax to the Roth instead of After-Tax tax?

Reducing their taxable income and tax bill today is important for most Microsoft employees as they will fall in some of the higher tax brackets. Our suggestion is usually to max out all pre-tax opportunities available to you before contributing after-tax (including the Deferred Compensation account for those Level 67+). By maxing out your 401(k) pre-tax and adding extra dollars into the after-tax Roth, you are getting the best of both worlds—a tax break today and tax-free dollars for the future.

Should I invest extra savings into a taxable account or the after-tax Roth 401(k)?

Here, the decision comes down to one thing—timing. Because there are restrictions on when you can access your 401(k) retirement savings without penalty, they should be saved into a taxable account if the funds are needed before retirement.

Should I contribute to my Deferred Compensation Plan (DCP) or the Mega Backdoor Roth?

The Microsoft DCP is available to employees starting at level 67. Typically, you are paying taxes at some of the highest tax brackets at this level. In this case, we often find that it makes more sense to defer income and reduce your current tax bill vs. contributing after-tax dollars into the Roth 401(k).

Of course, this is a decision that’s specific to each person. Additional considerations are tax diversification (how much money you have in each tax bucket—taxable, tax-deferred, and tax-free) and how much of your net worth is already in the Microsoft DCP, which is an unsecured liability of the company.

Pros and Cons of the Microsoft Mega Backdoor Roth Conversion

With every decision in finance and life, there are trade-offs. The Mega Backdoor Roth is no exception.

Let's look at this account's main pros and cons.

The Pros of the Mega Backdoor Roth

- Unlocks additional tax-advantaged savings opportunities of up to $30,250 for Microsoft employees

- Tax-deferred growth of your investments

- Tax-free withdrawals from the account in retirement

The Cons of the Mega Backdoor Roth

- It's designed for long-term savings not to be touched until retirement

- There are no tax breaks today for after-tax contributions into the Mega Backdoor Roth account

Is the Mega Backdoor Roth a Good Idea?

So, as we draw to a close on this post, it’s worth addressing one final question: Is the Mega Backdoor Roth worth it?

As one of the most significant benefits available to you as a Microsoft employee, it’s worth considering the strategy as part of your overall financial planning.

As financial advisors working with tech professionals, we find it typically works best for those who are:

- Not yet eligible to defer income via the Microsoft Deferred Compensation Plan

- Have funded their short- and medium-term goals

- Have additional money to save over the year

- And (or) want to build tax diversification via an additional tax bucket

FAQ’s

The Mega Backdoor Roth can only be done through your 401(k) account and this allows you to contribute more money into the account.

Yes. Microsoft employees can contribute up to an additional $30,250 in 2022 on an after-tax basis into the Microsoft Mega Backdoor Roth account.

In 2022, the maximum Federal contribution to a 401(k) account is $61,000. This means after contributing $20,500 at the individual level and Microsoft’s match of $10,250, you are left with the ability to contribute another $30,250 into your Microsoft 401(k).

The Microsoft 401(K) does allow the Mega Backdoor Roth feature. However, not all employers do so. You must max out your pre-tax 401(k) contributions ($20,500 for those under 50 and an additional $6,500 for those over 50) before allocating money into the after-tax Mega Roth account.

The Microsoft 401(k) match is generous, so take advantage! Microsoft will match 50% of your contributions to $10,250 in 2022. To get the full match, you need to max out your contributions and save $20,500 into the 401(k).

Conclusion and Action Items

As we just saw, Mega Backdoor Roth 401(k) can be an awesome strategy for Microsoft employees to allow them to increase their tax-advantaged savings and build a tax-free source of income in retirement. But it isn’t going to make sense for everyone.

To take the next step with this strategy, your actions are:

- Assess if the Mega Backdoor Roth makes sense for you

- If so, determine how much to allocate to the account this year

- Lastly, make sure to update for 401(k) elections via Fidelity Net Benefits

The information contained in this post is based on Cordant’s understanding of the Microsoft 401(k) plan at the time it was written. The Plan is subject to change by Microsoft. Please see your latest Plan document for the most up-to-date information.