As you would expect from an outstanding organization like Microsoft, it offers a very robust 401(k) to help employees save for retirement. This article will discuss the key features of the Microsoft 401(k) plan, and after reading it, you should leave with a clear game plan of how to:

- Maximize the match (free money! 💰) you receive from Microsoft

- Reduce your tax bill both now and in retirement 🤑

- Make smart investment decisions within your 401(k) account 🧠

Microsoft’s 401k Plan

The Microsoft 401(k) plan is offered to Microsoft employees, including employees of subsidiaries such as LinkedIn and other divisions of the company. These include:

- MOL Corporation

- Microsoft Online, Inc.

- Vexcel Corporation

- Microsoft Payments, Inc.

- Microsoft Open Technologies, Inc.

- Microsoft Technology Licensing,

- Undead Labs

The Microsoft 401(k) plan is part of the comprehensive benefits offering that includes the Microsoft Corporation Employee Stock Purchase Plan and the Microsoft Corporation Deferred Compensation Plan.

The key benefits of any 401(k) plan (including Microsoft’s) include:

- Free Money: A company match on your contributions.

- Lower Taxes: Reduce taxes today via pre-tax contributions that reduce your taxable income.

- Tax-Deferred Investment Growth: Dividends, Interest and Capital Gains are not taxed within your 401(k) until retirement allowing your investment returns to compound faster.

What Company Does Microsoft Use For Their 401k?

Microsoft’s 401(k) provider is Fidelity Investments. According to research firm Cerulli Associates, Fidelity is a leading 401(k) plan provider with over $2.4 trillion in assets and more than a third of total 401(k) assets. Microsoft can offer a broad range of investment choices for plan participants through this platform.

How Microsoft’s 401(k) Plan Works

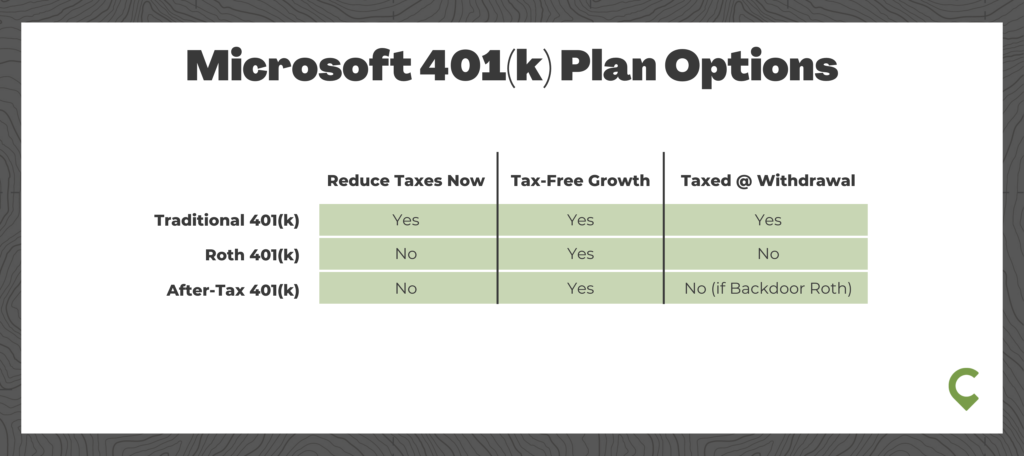

You have three options for contributing to the Microsoft 401(k) plan. The traditional 401(k) option offers the ability to make pre-tax contributions to the plan. There is a Roth 401(k) option and an option to contribute on an after-tax basis connected with the Mega Backdoor Roth option.

You can divide their contributions between a traditional 401(k) and the Roth 401(k) options in any fashion they choose. However, the maximum combined contributions cannot exceed $20,500 or $27,000 for those who are 50 or over.

Microsoft Traditional 401(k)

The Microsoft traditional 401(k) option entails making plan contributions on a pre-tax basis. Contributing pre-tax allows you to receive a tax benefit in the year you contribute via a reduction in taxable income. The contributions, plus any earnings on those contributions, grow tax-free and will then be taxed as ordinary income when withdrawn from the plan.

Microsoft Roth 401(k)

Contributions to the Microsoft Roth 401(k) are made after-tax. The money grows tax-free inside the plan and then can withdraw tax-free in retirement if certain conditions are met. One of the advantages of a Roth 401(k) is that there are no income limits on your ability to contribute as there are with a Roth IRA. With the Roth 401(k) option, you don’t reduce your taxes today but generate a tax-free retirement income source.

Microsoft After-Tax 401(k)

Microsoft is one of the employers that offer an after-tax option that allows you to make after-tax contributions above the pre-tax or Roth contribution limits. More about this is below in the Microsoft Mega Backdoor Roth section.

Microsoft 401(k) Eligibility

Microsoft employees who are at least age 18 are eligible to participate in the Microsoft 401(k) plan. There is no 401(k) eligibility waiting period or service requirement for participation.

Certain classes of employees and workers are excluded from participating in the plan, including:

- Union members

- Non-resident aliens

- Leased employees

- Independent contractors

- Temporary employees

- Interns

- Visiting researchers

- Co-op members

- Apprentices

If you have questions about your participation eligibility, contact the Microsoft plan administrator at (425) 882-8080.

Microsoft 401(k) Employer Match & Vesting Schedule

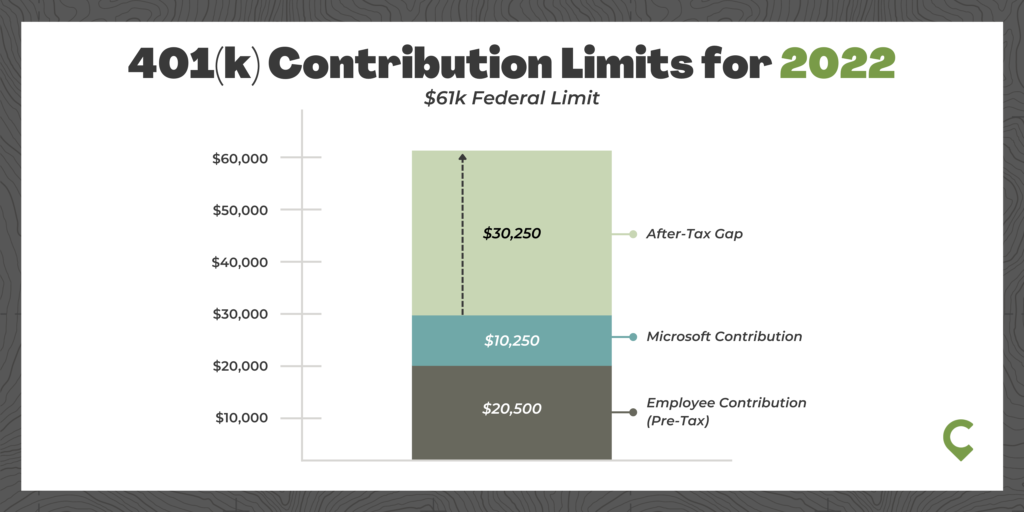

The Microsoft 401(k) employer match is a very generous 50% of the amount contributed by employees to the traditional and the Roth 401(k). This match is on all amounts contributed up to the annual contribution limit of $20,500 for 2022. There is no match for catch-up contributions for those 50 or over. Likewise, there is no employer match on after-tax contributions related to the Microsoft Mega Backdoor Roth option.

By rule, all matching contributions are made to a traditional 401(k) account regardless of whether some or all of your contributions are in the Roth 401(k).

Planning Opportunity: If possible, contribute at least $20,500 to get the full Microsoft match of $10,250. Getting the full match is like a nearly 7% raise on a $150,000 salary!

Microsoft has the most generous vesting schedule possible, with 100% of contributions, including Microsoft’s matching contributions, fully vested from day one.

Vesting refers to the ability of a participant to take all money in their 401(k) plan with them when leaving an employer. While their own contributions are always theirs to take, many employers have a graduated vesting schedule over which participants gain levels of ownership of company matching contributions.

In the case of the Microsoft 401(k) plan, vesting is immediate. This means that all your contributions and all employer matching contributions belong to you should they leave the company. You are free to direct 100% of this money as you see fit when leaving Microsoft.

Microsoft Mega Backdoor Roth Conversion 401(k)

While your pre-tax contributions are capped in 2022 at $20,500 (plus a $6,500 catch-up contribution for those 50 or older), the Microsoft Mega Backdoor Roth conversion option allows you to make after-tax contributions up to the IRA limit of $61,000 in 2022 (or $66,500 for those 50 or older).

Planning Opportunity: Those maxing out their pre-tax contributions, and getting the full match from Microsoft, could still contribute $30,250 to this tax-advantaged account

Microsoft converts these after-tax contributions to the plan’s Roth 401(k) option. These conversions are tax-free unless there have been any earnings on the after-tax contributions.

For those participating, this process allows you to build up significant sums in their Roth 401(k) accounts that can be withdrawn tax-free in retirement or rolled over to a Roth IRA account when they leave Microsoft.

The Microsoft 401(k) Rollover

The Microsoft 401(k) plan accepts rollover contributions from other 401(k) plans and IRAs. This is subject to these rollover assets meeting the criteria set by the plan.

Subject to the company’s 401(k) rollover rules, this can be an option for employees to consider. If you have assets in a 401(k) plan at a prior employer, rolling these assets into the Microsoft 401(k) or an IRA at an outside custodian, plan might provide a solid option as opposed to leaving these assets in the plan of your former employer.

Whether or not rolling these assets into the Microsoft 401(k) plan is advantageous will depend on factors such as:

- Investment options in each plan compared to an outside custodian

- Consolidation and simplicity

- Whether you feel more comfortable with these assets in the Microsoft 401(k) than in an IRA with an outside custodian.

Microsoft 401(k) Investment Options

The Microsoft 401(k) plan offers a variety of investment options covering a wide range of investment asset classes.

The plan offers a number of investment options from top money managers including:

- BlackRock Short-Term Investment Account

- Vanguard Short-Term Bond Index Fund –Institutional Plus Class

- PIMCO Total Return Account

- PIMCO Inflation Response Multi-Asset Fund –Institutional Class

- PIMCO All Asset All Authority Fund –Institutional Class

- Vanguard Russell 1000 Value Index Trust

- Vanguard S&P 500 Index Trust

- Vanguard Russell 1000 Growth Index Trust

- Fidelity Growth Company Commingled Pool

- Fidelity Contrafund Commingled Pool

- International Value Account

- International Growth Account

- Artisan Mid Cap Account

- DFA Small/Mid Cap Value Account

- Vanguard Russell 2000 Growth Index Trust

The plan offers the BlackRock LifePath Index 2025-2065 Funds N Class for participants wanting a managed account option. These are target date funds with a range of target retirement date options and levels of risk. There is also an option to invest in Microsoft Stock.

Lastly, a Brokerage Link option allows participants to invest their plan assets in a self-directed account. The quality of the options offered in the plan and the variety of choices make the investment menu in the Microsoft 401(k) plan a positive feature.

But How Should I Invest My 401(k)?

The question we are often asked by clients who work for Microsoft is how to choose the best mix of investments for their situation. This is never a simple question; the answer will always depend on your unique situation. Here are four factors to consider in making your investment choices.

Decide upon your asset allocation

The first step in investing your 401(k) is determining your “asset allocation,” which is simply the mix of stocks, bonds and cash you’ll hold. This mix of assets is the main building block of your portfolio and will primarily determine the risk and return in the account. Once this high-level determination is made, you can get more granular by selecting an allocation for US vs. International stocks. You can choose from growth and value, small, mid and large-cap funds, as well as emerging market funds.

The main point here is that you should determine your overall allocation and risk level before picking any specific funds to be in this account. Looking at the Microsoft 401(k) plan as part of your overall portfolio is important.

Active or index funds

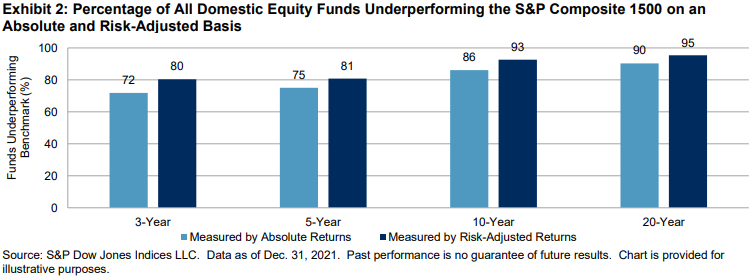

The next decision you’ll need to make is to decide if you will use actively managed or index funds to fulfill your target allocation. The Microsoft 401(k) retirement plan offers many excellent choices among actively managed and index funds. Actively managed funds try to beat their benchmark index by making active decisions as to which stocks and bonds to buy, sell and hold. Index funds seek to passively track the performance of an index such as the S&P 500.

Over the years, many index funds have outperformed their active counterparts. Additionally, index funds generally have lower expenses than their actively managed peers because a research staff is not required, and index funds tend to make fewer transactions.

According to S&P Dow Jones which tracks the performance of actively managed funds each year:

Fund managers often respond to evidence of active underperformance by claiming to offer better returns per unit of volatility (i.e., to outperform in risk-adjusted terms). This would be an appropriate counterargument, if only it were true. However, the data shows that the vast majority of actively managed funds underperformed on this metric as well. Among domestic equity funds, while 90% have underperformed the S&P Composite 1500 over the past 20 years, an even greater 95% did so on a risk-adjusted basis.

Minimize expenses

Many studies by credible sources have highlighted the impact that higher investment expenses can have on the value of your investments over time. A study by the SEC (Securities and Exchange Commission) showed that even the difference between investment expenses of 0.25% annually compared to 0.50% annually can lead to a significant difference in the value of your investments over time.

Along with asset allocation and the quality of a particular investment option, fund expenses should also be considered when making your investment selections.

Analyze fund performance

When reviewing the various funds offered by the plan, be sure to review the performance of each fund relative to its benchmark index and other funds in its category. For example, the Fidelity Contrafund Commingled Pool is a large-cap growth fund. The fund’s performance should be compared to other funds in this category and to a benchmark like the Russell 1000 Growth Index.

In addition to these steps, there are two other considerations based on the options offered in the plan.

What About Microsoft Stock?

Microsoft stock has been a solid performer over the long term. Its gains have solidly outpaced the S&P 500 and other benchmarks over time. As a result, long-term shareholders have been handsomely rewarded in many cases.

But, even with a stock that has performed as well as Microsoft has over time, concentrating your investments on a single stock is risky.

According to a Longboard study titled “The Capitalism Distribution: Observations Of Individual Common Stock Returns, 1983 – 2006,” they found that:

- 39% of stocks were unprofitable investments

- 18.5% of stocks lost at least 3/4th of their value

- 64% of stocks underperformed the Russell 3000

- 25% of stocks were responsible for all of the market’s gains

And the risk is even higher for your employer’s stock as your salary, bonus, and RSU compensation are tied to its success.

Brokerage Link

The plan’s brokerage link is an option that allows participants to use some or all of their contributions in a brokerage option that offers a wide range of securities like individual stocks, mutual funds, ETFs and others. These are options outside the plan menu of fund options that are chosen in conjunction with the plan’s outside advisor.

This can be a good option for experienced investors looking for investment alternatives beyond the funds or Microsoft stock offered by the plan.

Microsoft 401(k) Terms of Withdrawal

The Microsoft 401(k) offers several withdrawal options that participants should be aware of.

In-service distributions are allowed from the plan under certain circumstances, including:

- After-tax contributions at any time

- Rollover contributions at any time

- Non-safe harbor matching contributions at age 59 ½ or older

- Pre-tax elective deferral contributions at age 59 ½ or older

- Roth elective deferral contributions at age 59 ½ or older.

In-plan conversions from a traditional to a Roth option are allowed; check with the plan administrator to get the exact rules surrounding them.

The plan also offers a loan option; check with the plan’s administrator to find out more about how the plan’s loan option works.

Hardship distributions are allowed under the plan’s rules for these types of distributions. Again, it is best to contact the company’s plan administrator if you need this option.

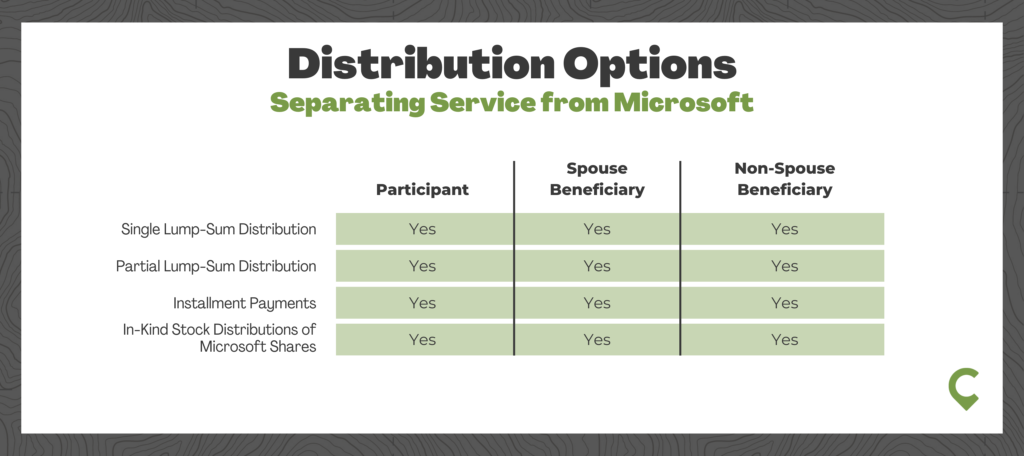

Several distribution options are available to participants upon separating service from Microsoft.

The company will automatically cash out your pan balance for participants leaving the company with $5,000 or less in their 401(k) account.

Action Items & Summary

Microsoft’s 401(k) retirement plan is a significant benefit for those working for Microsoft, but you can’t capture those benefits unless you take action.

To maximize the value of your Microsoft 401(k):

- If possible, contribute at least $20,500 to get the full Microsoft match of $10,250

- Consider contributing after-tax and take advantage of the Mega Backdoor Roth Option

- Set your asset allocation for the account, use the 4-step framework to pick the best funds for you, and rebalance frequently

The 401(k) might seem like one of the most vanilla of all Microsoft benefits, but with a little knowledge and annual planning, you can fully capture the value of Microsoft’s fantastic plan.

The information contained in this post is based on Cordant’s understanding of the Microsoft 401(k) plan at the time it was written. The Plan is subject to change by Microsoft. Please see your latest Plan document for the most up-to-date information.