Need Help?

Table of Contents

ToggleThis article covers what a donor-advised fund is and why you should consider one. We also get you up to speed on the tax benefits of using a DAF.

If you've heard of a DAF and are curious about incorporating it into your giving and tax planning strategy, this article is for you.

Key Takeaways:

- Contributions to a donor-advised fund reduce your tax bill in the year your contribution is made.

- A DAF provides flexibility as you can spread your giving to charities over time and facilitate giving to multiple charities from one account.

- You can donate appreciated assets to your DAF, avoiding capital gains taxes and further lowering your tax bill.

- For those already charitably inclined, a DAF can be a powerful tool in your annual tax planning strategy.

What is a Donor Advised Fund?

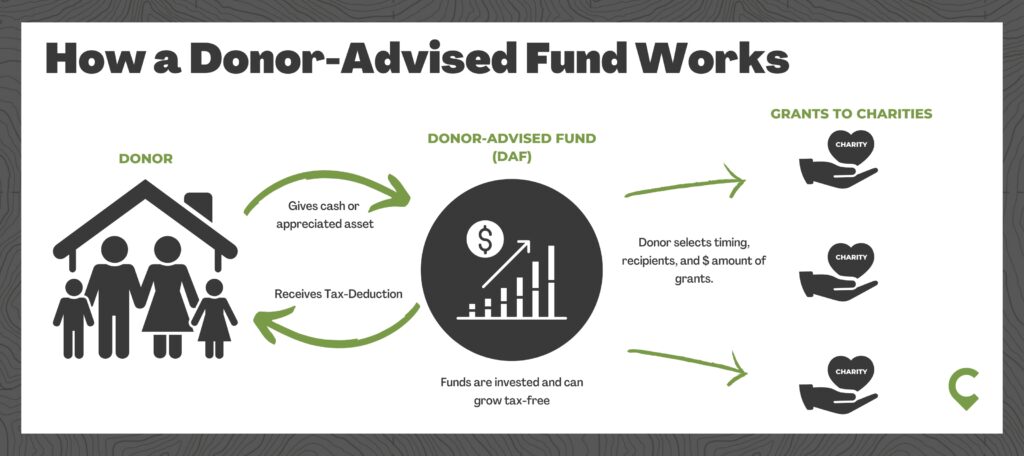

A donor-advised fund is a charitable investment account that allows you to support your preferred charities over time while receiving a tax deduction upfront.

The donor receives a tax deduction in the year the contribution is made, and the donated assets continue to grow tax-free in the account until the donor gifts them to the qualified charities of their choice.

An added bonus of donor-advised funds is the ability to donate highly appreciated shares of stock (or other assets), avoiding capital gains tax that would otherwise be owed.

Facts About Donor-Advised Funds

Here are some interesting statistics about Donor-Advised Funds from the National Philanthropic Trust's 2024 DAF Report:

- Total grants for 2023 were $55 billion

- Total contributions were $60 billion

- Total assets in Donor-advised funds rose to more than $250 billion in 2023

- The DAF payout rate was 24% and has been above 20% for each year they have recorded

The Tax Benefits of Donor-Advised Fund?

As we just mentioned, a Donor Advised Fund (DAF) comes with two tax advantages:

- An income tax deduction in the year of your contribution

- And the ability to avoid capital gains taxes on appreciated assets

When you contribute to a DAF, you receive a tax deduction for the total fair market value in the contribution year. The following rules and limits do apply:

- You must have held the asset for more than one year

- Cash donations are deductible up to 60% of your adjusted gross income (AGI is found on line 11 of your 1040)

- Appreciated securities are deductible up to 30% of your AGI

- Any unused deduction can be carried forward for up to five years

The second tax benefit of a DAF comes from avoiding capital gains taxes when donating appreciated assets. Here's an example:

Let's say you own stock worth $100,000 with a cost basis of $20,000:

- Without a DAF, you'd owe capital gains tax on the $80,000 appreciation ($19,040 at the 23.8% long-term capital gains rate for high earners)

- Instead, if you use the stock to fund your DAF, you pay no capital gains tax AND get a $100,000 income tax deduction (up to the 30% of AGI threshold)

This double tax benefit makes a DAF particularly attractive. While the tax benefits are immediate, you can take your time deciding which charities to support with the funds.

Why Consider Donor Advised Fund?

Here are four reasons you might consider a donor-advised fund.

1. You regularly give to charity but don't get the full tax deduction.

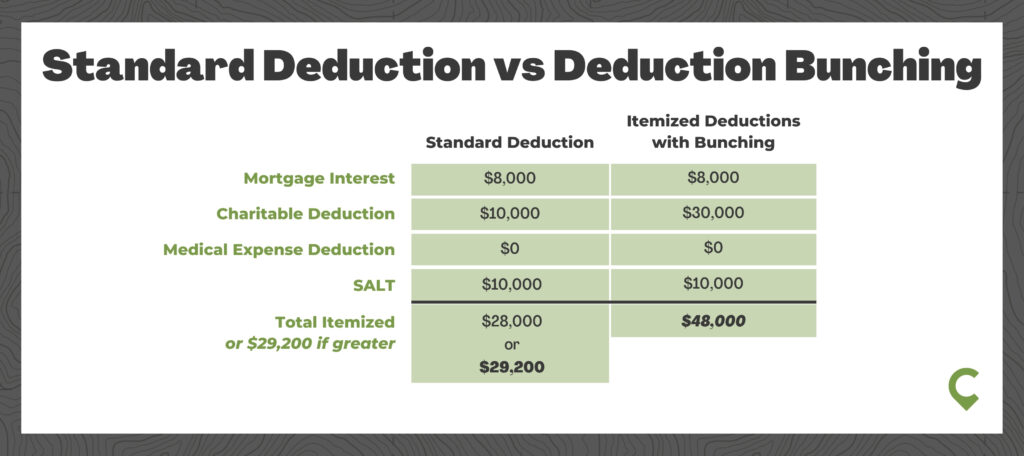

Many people give regularly to charity but can't claim the tax benefits because their total itemized deductions fall below the standard deduction threshold ($14,600 for single filers and $29,200 for married couples filing jointly in 2024).

Enter a charitable "bunching" strategy: Instead of giving $10,000 annually, you might contribute $30,000 to a DAF in a single year, then distribute those funds to charities over the next three years. This "lumpy" giving approach helps you exceed the standard deduction threshold in contribution years while maintaining the flexibility to give to charities over time.

2. You are in a high-income year

A DAF (or any tax planning, for that matter) is particularly valuable during high-income years when your marginal tax rate is high. This could be due to:

- Significant equity compensation

- Large performance bonuses

- Separation packages

- Exercising stock options

By front-loading your charitable giving during these peak earning years, you can maximize the tax benefit of your donations while your tax rate is highest.

3. You're sitting on significant capital gains

If you're holding highly appreciated shares of stock, a DAF offers a powerful double tax benefit.

First, you can deduct the value of your donated stock (up to 30% of your AGI) to reduce your taxable income. Next, the double benefit comes from avoiding capital gains on the appreciation.

So, a donation of $100,000 in stock with a cost basis of $20,000 net both a $100k deduction to income and avoids capital gains tax on the $80,000 of appreciation.

4. To simplify your giving process

Managing multiple charitable donations throughout the year can be administratively burdensome. A DAF consolidates everything into one streamlined process:

- Make all your grants from a single account

- Access one consolidated tax receipt at year-end

- Maintain detailed records in one place

Think of it as a charitable checking account – you fund it when it makes sense for you tax-wise, then distribute grants to your favorite charities at your convenience.

Still wondering if a DAF is right for you? Check out our flowchart "Should I Use A Donor Advised Fund (DAF) When Giving To Public Charities?"

Real-World Example: Sarah’s Story

Sarah, a senior software engineer at a successful startup, received stock early in her tenure with the company. After the company's IPO, her shares were worth $500,000 but only had a cost basis of $25,000. She wanted to support several educational charities but was concerned about the tax implications of selling her shares.

By contributing her $100,000 of appreciated shares to her new DAF, Sarah:

- Avoided paying capital gains taxes on $95,000 of appreciation (cost basis of $5k)

- Received a $100,000 charitable deduction for this tax year (Her AGI exceeds $300k, so she can take the full deduction in one year)

- Created a charitable giving fund that will support multiple educational nonprofits but will allow her time to get involved and vet options

- Simplified her giving process by managing all donations through a single platform

DAF Frequently Asked Questions

While tax laws can change, DAFs have been a stable part of the charitable giving landscape for decades. Current proposals focus on distribution requirements rather than the fundamental tax benefits of DAFs.

The 2017 Tax Cut and Jobs Act capped state and local tax (SALT) deductions at $10,000, making a charitable "bunching" strategy via a DAF even more valuable, so you get the full tax deduction for your giving.

Yes. You can deduct the full fair market value of appreciated stock held for over one year, up to 30% of your adjusted gross income (AGI). Any unused portion can be rolled forward and used over the next five years.

Your DAF can be used to support any organization that is tax-exempt 501(c)(3) and classified as a public charity under 509(a). According to the National Philanthropic Trust, DAF funds can be used "to support qualified nonprofits in arts and culture, the environment and animal welfare, food banks and hunger alleviation, educational and religious institutions, social service organizations, and more."

You cannot use a DAF to support political organizations, private foundations, or for personal benefit (such as school tuition for a child or relative).

Additionally, with a DAF, you or your investment advisor, can direct the account's investment strategy. Investment options will vary based on your DAF custodian, such as Schwab Charitable, Fidelity Charitable, etc.

Two fees are associated with a donor-advised fund: administrative fees and investment fees. The investment fees will vary based on the investments selected. The administrative fees will range based on your account balance and the custodian.

At Schwab Charitable, admin fees range from 0.60% of the account balance annually (on the first $500k of assets) down to 0.10% annually (above $15m in assets). The full pricing can be found here.

At Fidelity Charitable, admin fees range from 0.60% of the account balance annually (on the first $500k of assets) down to 0.15% annually (above $2.5m in assets). The full pricing can be found here.

Besides the costs of administering your DAF, the main (potential) drawback is that your contribution to a DAF is irrevocable. Once the funds are in the account, they can no longer be used for your personal benefit and must be given to charity.

Next Steps: Getting Started with a DAF

- Evaluate your charitable giving goals

- Develop a giving strategy that aligns with your goals and optimizes for taxes

- Setup an account with a DAF sponsor

- Reach out to your financial advisor and (or) CPA for help

Recommended Resources

- Your financial advisor or tax professional

- DAF sponsor websites and educational materials (Schwab Charitable, Fidelity Charitable)

- IRS Publication 526 (Charitable Contributions)

- National Philanthropic Trust's annual DAF Report

Conclusion

Donor-advised funds offer a powerful opportunity to do well while doing good. They bring the benefits of tax efficiency, flexibility in when to make grants, and simplified giving. And by contributing appreciated shares, you can simultaneously maximize your impact and minimize your taxes.

Whether in a high tax bracket, planning for an IPO, or just looking to optimize your charitable giving, a DAF deserves consideration as part of your overall financial strategy.

And, if you need help, connect with us to explore how this powerful tool can help you make a lasting impact while optimizing your tax situation.